For tenants ⌄

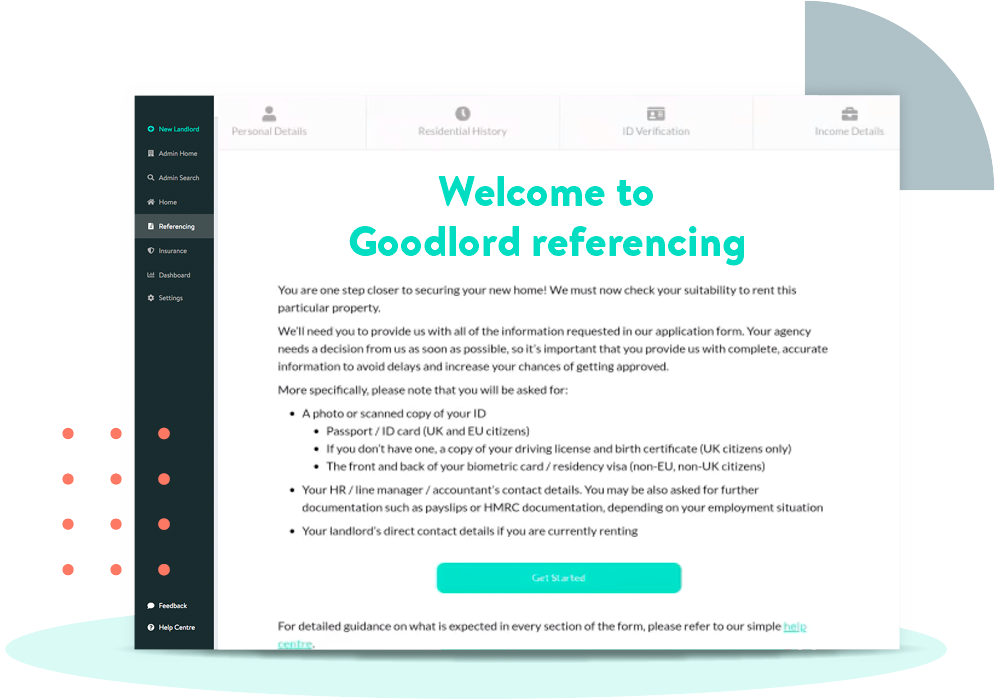

Referencing

Utility switching

Contents & Liability Insurance

Move-in ready services

Deposit Replacement Service

Illness & Injury Insurance

Newsagent ⌄

The Goodlord Blog

Webinars

Ebooks

Resources

Goodlord Rental Index

Lettings Activity Tracker™

Events

Agency case studies

Company ⌄

Support

Login

Tenant offers